In the ever-evolving landscape of economic policy, two powerful tools often come into play: tariffs and tax incentives. Governments around the world employ these measures to shape their economies, protect domestic industries, and promote desired behaviors among businesses and consumers. Tariffs on some imported PCBs from China are currently being employed and a 25% tax credit for purchasing domestic PCBs (part of the recently introduced legislation, The Protecting Circuit Boards and Substrates Act) is actively being discussed in DC, making this a pertinent topic to our industry. However, the debate over which approach is more effective and beneficial for a country’s economic well-being remains contentious. We will explore the key differences between tariffs and tax incentives and analyze their respective impacts on trade, industries, and overall economic growth.

Understanding Tariffs:

Tariffs are import taxes levied by a country on foreign goods and services. Governments impose tariffs with the intention of protecting domestic industries from international competition, safeguarding employment opportunities, and fostering the growth of local businesses. By raising the cost of imported goods, tariffs aim to make foreign products less attractive to consumers, thereby encouraging them to purchase domestically produced alternatives.

One of the primary advantages of tariffs is the potential for increased government revenue. As imported goods face higher costs, governments can generate funds from these duties, which can be utilized for public services, infrastructure development, or social programs. Additionally, tariffs offer a level of protection to certain industries, shielding them from the fluctuations of global markets and providing them with opportunities to establish themselves on a stronger footing.

However, tariffs also come with significant downsides. When countries retaliate by imposing their tariffs on the exporting nation’s goods, it can escalate into a trade war, causing harm to both economies. Furthermore, tariffs may lead to higher consumer prices, reducing purchasing power and potentially lowering overall economic growth. Tariffs can also limit access to foreign products, reducing the variety and quality of choices available to consumers.

Exploring Tax Incentives:

Tax incentives, on the other hand, are government policies that provide tax breaks, credits, or deductions to businesses or individuals for specific behaviors or investments. These incentives aim to stimulate economic activity, attract foreign investment, promote research and development, and create job opportunities. By reducing the tax burden on targeted sectors or activities, tax incentives aim to incentivize companies and individuals to engage in activities that align with the government’s economic goals.

One significant advantage of tax incentives is their flexibility. Governments can tailor these policies (much like the aforementioned 25% credit) to suit their unique economic needs and encourage certain industries or activities without directly restricting trade or imposing barriers on imports. Tax incentives can attract foreign direct investment, boost innovation, and support the growth of emerging industries.

However, critics argue that tax incentives can lead to reduced government revenue, potentially resulting in budget deficits and limiting the funding available for essential public services. Additionally, there is a risk of favoritism or lobbying influence, with powerful industries or corporations benefiting disproportionately from these incentives, creating an uneven playing field for competition.

Striking the Balance:

When it comes to economic policy, finding the right balance between tariffs and tax incentives is crucial. Governments must consider the specific needs and challenges of their economies while avoiding protectionist measures that could escalate into harmful trade wars. In some cases, a combination of both policies might be the most effective approach. For instance, tariffs can protect vulnerable domestic industries, while tax incentives can encourage innovation and attract foreign investments.

Moreover, it is essential to regularly evaluate the effectiveness of these measures and make adjustments as needed. Economic conditions change over time, and policies that once served their purpose may become obsolete or even detrimental in the long run.

Tariffs and tax incentives are powerful economic policy tools that governments can utilize to influence trade, industries, and overall economic growth. Tariffs protect domestic industries but may lead to trade tensions and higher consumer prices. Tax incentives stimulate economic activity but come with the risk of reduced government revenue and potential favoritism. Striking the right balance between these measures is vital to promoting economic prosperity while fostering a fair and competitive global trade environment. By carefully evaluating the specific needs of their economies and regularly reassessing the impact of their policies, governments can steer their countries towards sustainable and inclusive growth.

MORE FROM THE BLOG

PCB Manufacturers in the Electronic Vehicle Game

The Growth of Electric Vehicles The automotive industry's heavy-hitters are transforming their businesses and placing millions of R&D dollars into the future. What is the future you ask? You guessed correctly, electric vehicles (EV). Year over year we have...

Newsletter: January 2024

It’s a new year and optimism comes with it! We are excited to get moving on quite a few advanced package projects and believe this is one of the future markets for our team.

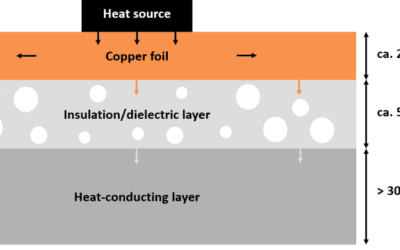

The Advantages of Insulated Metal Substrates in Printed Circuit Boards

In the dynamic landscape of electronics, the choice of materials for printed circuit boards (PCBs) plays a pivotal role in determining the overall performance and reliability of electronic devices. Among the innovative solutions gaining traction is the use of...

Newsletter: December 2023

We would like to share a message of resilience and hope for Aurora Circuits and the domestic PCB/advanced packaging industries from our President, Chris Kalmus.